In 2020, many changes took place with the rapid spread of the pandemic, which for the most part had a significant impact on all business sectors as they had to shift their processes to the Internet. However, this repositioning created major opportunities for digital payment gateways.

Knowing how these changes have affected the world, we compiled four payment trends started to form after Covid-19 and will continue in 2024

Remote payments ensuring COVID-19 is not transmitted begun and will remain

The Corona (COVID-19) virus changed how companies accept payments; no one wants to touch money or hand over a piece of plastic (debit/credit cards), in addition to that, bank checks and cash-on-delivery payments became ineffective as many employees are still working from home, thus, all sectors are adopting Corona – free payments now.

According to the National Retail Federation of the United States of America, 67% of American retailers now accept some kind of contactless payment, and in Europe, Visa reports that 75% of payments in stores are now touch-free. Many enterprises are also moving towards digitizing invoices, and payments and reaping the benefits of this digital transformation.

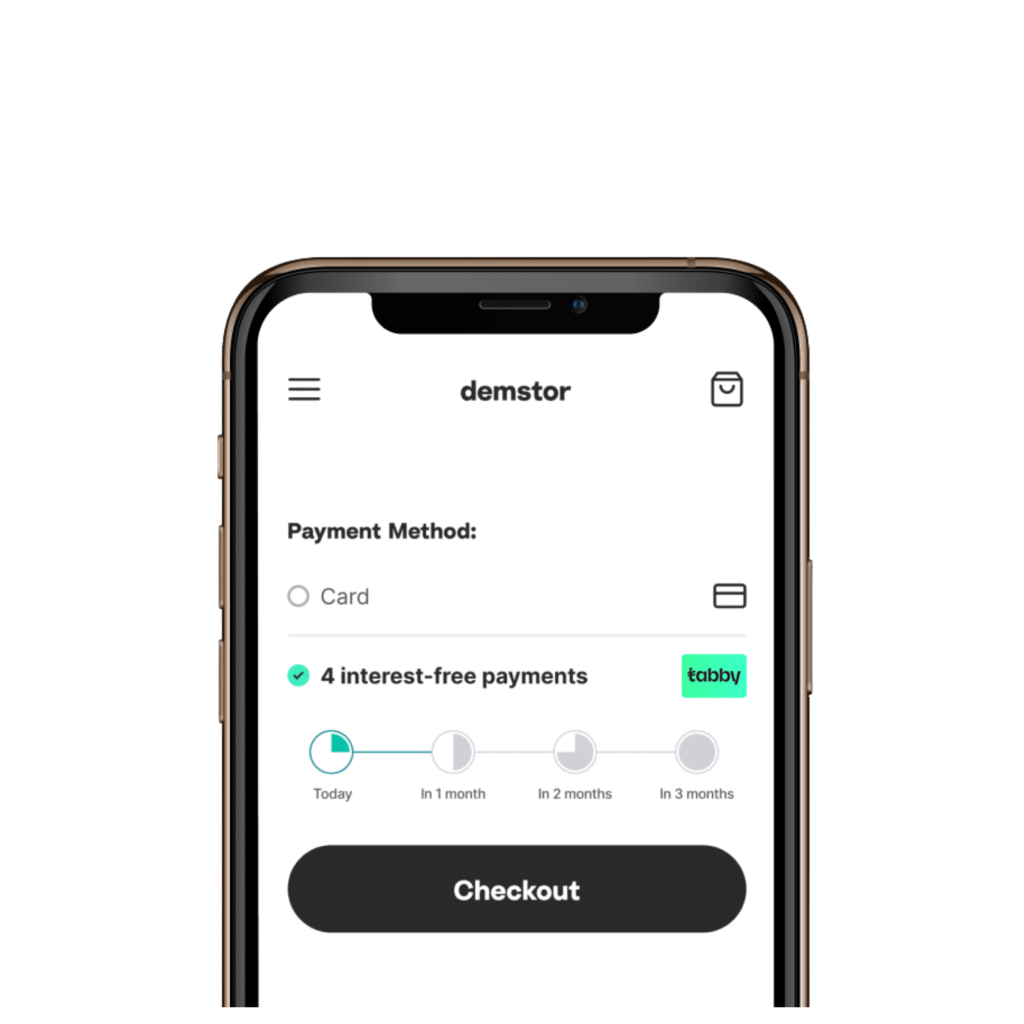

Installments – Buy now and pay later

As an emerging trend, many e-commerce sites began offering payment options that facilitate installments such as Tabby, and Spotii; both are payment portals adopted on a wide range of UAE and Saudi shops that allow customers to pay over some time without any interest. More consumers now see this option as desirable and encouraging as these installments can sometimes be cheaper than credit card fees.

Aware of the competition these payment options pose, some banks in the Arab region tended to cancel the credit card interest fees on essential products. For example, Union Bank in Jordan now allows installing the bill on heating Diesel purchases without interest, similarly, furniture and home office fittings are included under this offer.

Integrating one payment provider across all platforms

With all the changes in shopping patterns, another emerging trend is ordering via the website or social media and picking up the product, food, or coffee from curbside or drive-through, which means that all previous attempts by brands to separate physical points of sale from the online payment portals have been canceled in 2020 and brands needed to adapt to the new situation.

Moreover, as the Internet continues to overlap in everyday life, customers expect to be identified as a person, not a series of anonymous transaction numbers and the Omnichannel technology makes it possible and facilitates transactions for both parties.

Retailers will opt out of various payment gateways to reduce costs and maintenance

Before COVID-19 some retailers used several payment gateways alongside each other in order to cover multiple geographic areas and accommodate customers’ preferences. However, maintaining multiple payment portals is costly, and may be time-consuming to merge data from different payment systems and link them.

Prolonged home quarantines had its toll on the economy in general, and this turmoil pushed companies and websites to reduce costs by eliminating all that is unnecessary including technical debt through using a comprehensive payment solution. Knowing that the right platform will reduce contribution costs and provide different payment methods by dealing with a single, inclusive payment platform and local banks.

In conclusion, this virus has affected the way we communicate, shop, work, and pay and continues to impact us, therefore, this need for digital payment options is not going away anytime soon.

At Paymennt, we helped many businesses across the UAE adapt to the online requirements by launching The PayLink app; which allows them to receive payments online without even requiring a website and facilitates payments for the customers as they can use Visa Card, Mastercard and soon Apple Pay without the need to download the app themselves. That is in addition to providing an electronic store backed up by a payment portal.

Contact us for more information