In today’s digital landscape, merchants have a variety of options for accepting payments. While online stores, bank transfers, and traditional methods remain popular, payment links are emerging as a convenient and efficient solution, especially in the MENA region.

This guide will explore:

- What are payment links?

- How to create payment links effectively

- The benefits of using links for your business

- Best practices for implementing paymennt links

By understanding payment links and their advantages, you can streamline your payments processes and enhance your business operations.

What is a Payment Link?

A payment link is a simple, secure way to request customer payments. It’s a unique URL, button, or QR code that directs customers to a checkout page to complete a purchase. Payment links are versatile, allowing businesses to quickly generate them for sharing via email, social media, text messages, or even in-person transactions. No coding or technical expertise is required to set up, making them accessible to all types of businesses.

How do Payment Links Work?

Creating and using a payment link is straightforward:

- A business generates a link via its payment platform or app.

- The link is shared with customers through different channels (email, SMS, social media, or in person via QR codes).

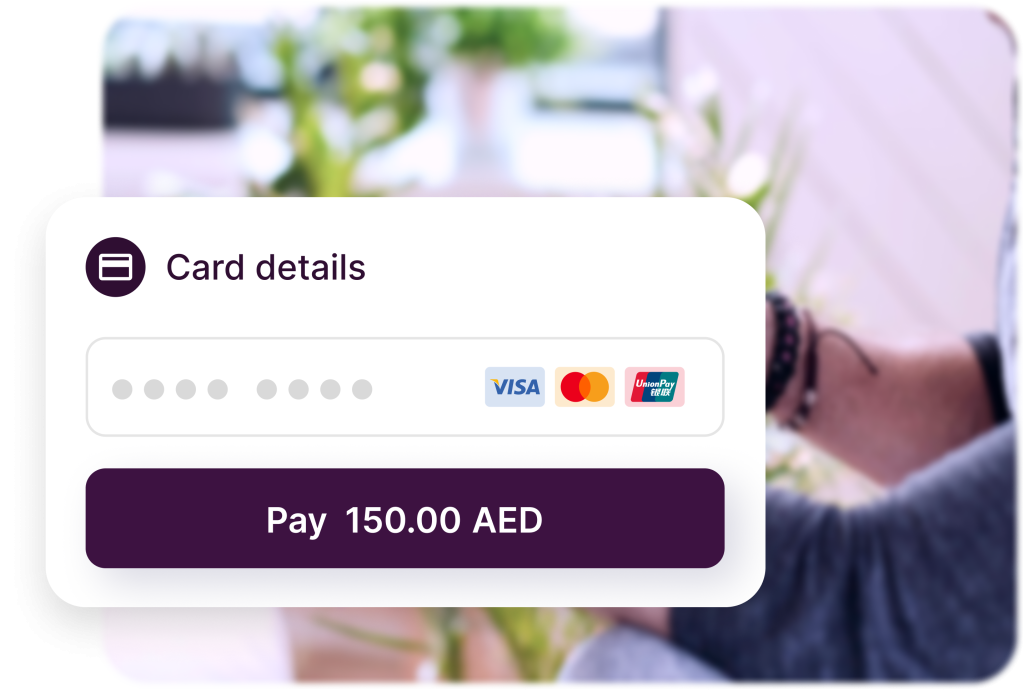

- Customers click the link, which directs them to a secure checkout page to complete their payment.

Is a Payment Link Safe?

Yes, payment links are extremely safe. They come with multiple layers of security, including encryption, to protect transaction details. Platforms like Paymennt ensure that payment links are foolproof, making it easy to confirm that payments go to the right place. Both merchants and customers receive confirmations for each transaction, adding another layer of security.

Who Uses Payment Links?

Many businesses find payment links to be an invaluable tool for simplifying their payment processes. Here’s a closer look at how different types of businesses utilize payment links:

Merchants Without Websites: For businesses without an online presence, payment links offer a seamless way to request and receive payments. Whether you run a local shop or operate through social media platforms, payment links enable you to generate invoices and collect payments directly from your customers, bypassing the need for a traditional e-commerce site.

SMS Marketers: Businesses that leverage SMS marketing campaigns can integrate payment links to streamline transactions. By embedding payment links in text messages, marketers can provide an immediate and convenient way for customers to make purchases or pay for services, enhancing the effectiveness of their campaigns and improving conversion rates.

Fundraisers and Nonprofits: For organizations focused on raising funds, payment links serve as a quick and efficient method of collecting donations. By sharing payment links through various channels—such as emails, social media, or even printed materials—nonprofits can facilitate donations easily, reaching supporters who prefer digital payment methods.

Pop-Up Shops and Mobile Vendors: In-person sellers, such as those at pop-up markets or mobile stalls, benefit from the simplicity of payment links and QR codes. These tools eliminate the need for complex point-of-sale systems, allowing vendors to accept payments on the go. Customers can simply scan a QR code or click a link to complete their transactions, making the payment process smooth and efficient.

Service Providers: Freelancers, consultants, coaches, and other service-based businesses can use payment links to manage their billing. These links can be customized for one-time sessions, recurring subscriptions, or packages and sent directly to clients via email, text, or messaging apps. This flexibility helps service providers streamline their invoicing processes and ensures timely payments.

By integrating payment links into their operations, different types of businesses can improve their payment processes, making transactions easier for both themselves and their customers.

When to Use a Payment Link?

Payment links are versatile and can be used in various scenarios:

- Social Media Sales: If you’re selling on Instagram, Facebook, or TikTok, a payment link can move customers directly from a social post to checkout.

- Email Marketing: Include payment links in promotional emails to encourage direct sales.

- Text Message Marketing: Send a payment link via SMS for quick transactions.

- In-Person Sales: Use QR codes for easy payment at pop-up shops or events.

- Customer Service Chats: Include a payment link to finalize transactions during live chats with customers.

Benefits of Using Payment Links

- Fast and Easy to Set Up: Create and share links within seconds without needing any complex technical knowledge.

- Versatile: Send links through various channels like SMS, email, social media, or chat.

- Streamlined Checkout Process: Reduces friction, improving the shopping experience and increasing conversion rates.

- Global Reach: Payment links allow businesses to accept customer payments worldwide.

- Flexibility: Merchants can use payment links for one-time purchases, recurring payments, or large orders.

Advantages of Payment Links by Paymennt

- Ease of Creation: You can quickly generate links with just a few clicks.

- Share Anywhere: Payment links are not limited to SMS, email, or WhatsApp—you can share them across any platform.

- Control Over Link Validity: Set link validity for 30 minutes or up to 7 days.

- Bulk Payment Links: Ideal for merchants selling a single product or a few products, Paymennt allows you to create and share bulk payment links.

- Automatic Catalog Payment Links: Create a catalog of your products, and Paymennt will automatically generate payment links for each order.

- Customizable Payment Options: Customers can pay via Visa, Mastercard, Apple Pay, Careem Pay, or opt for installment plans with Tabby.

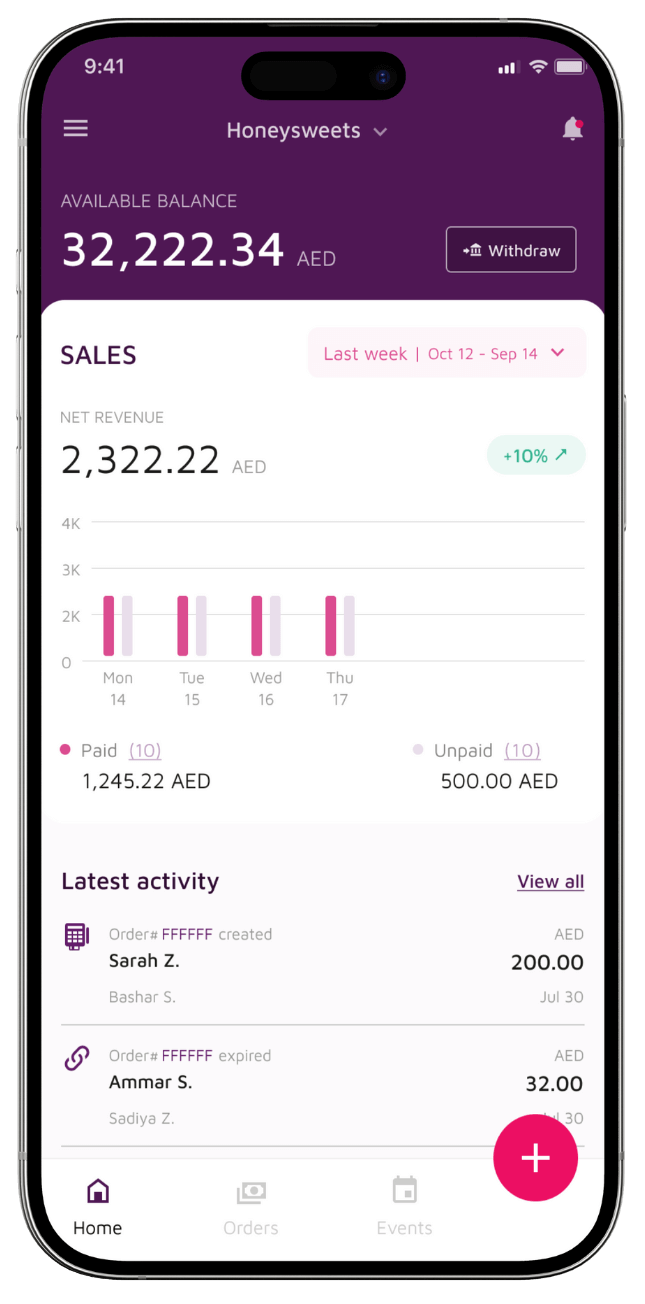

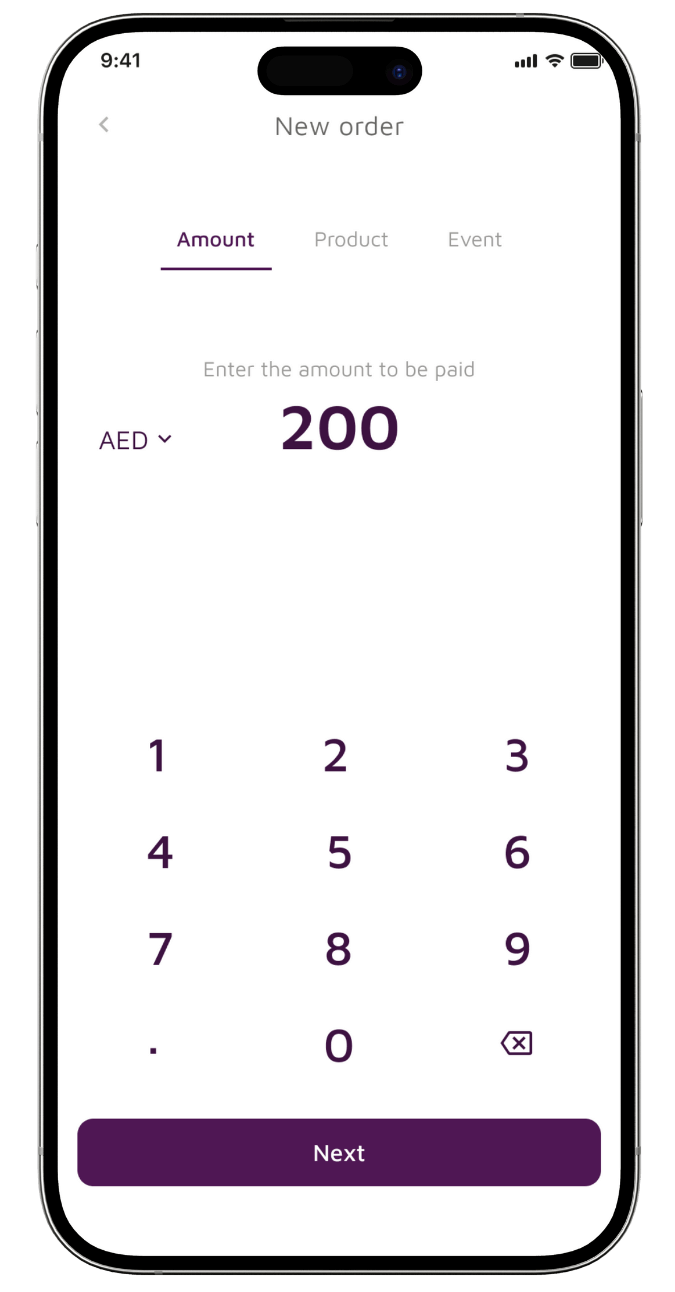

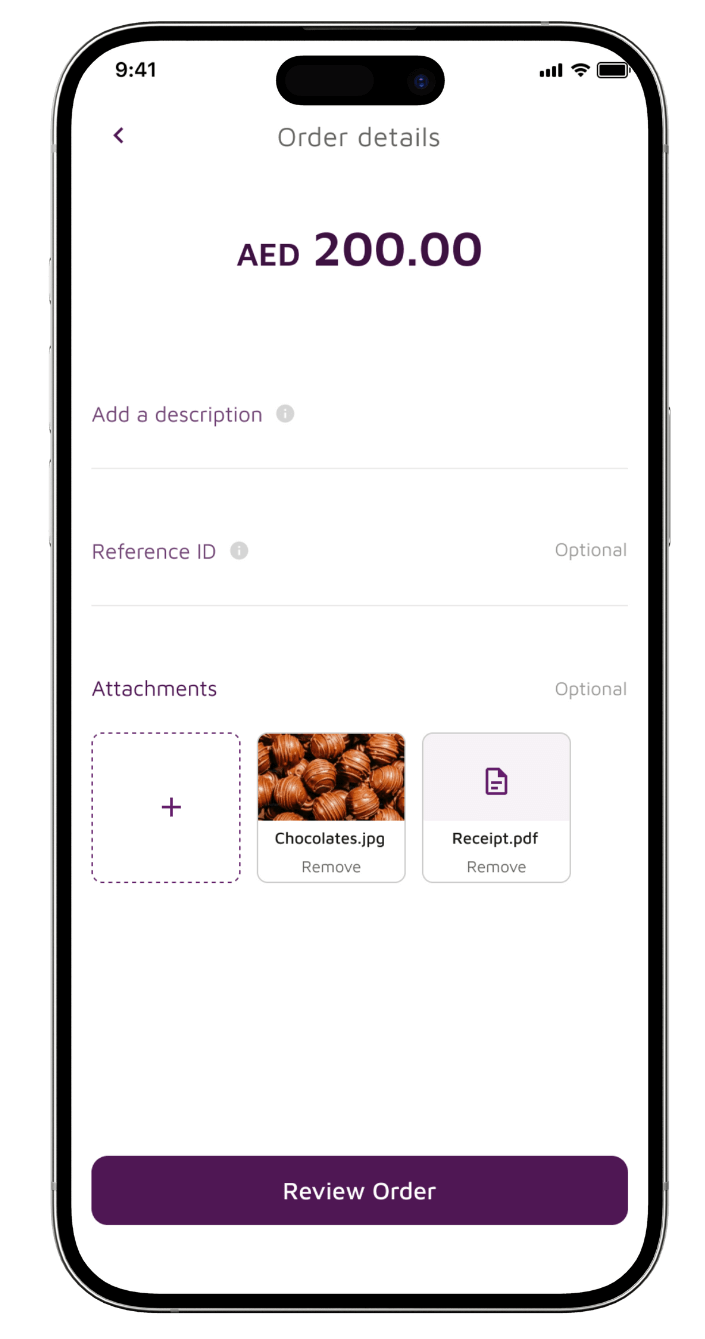

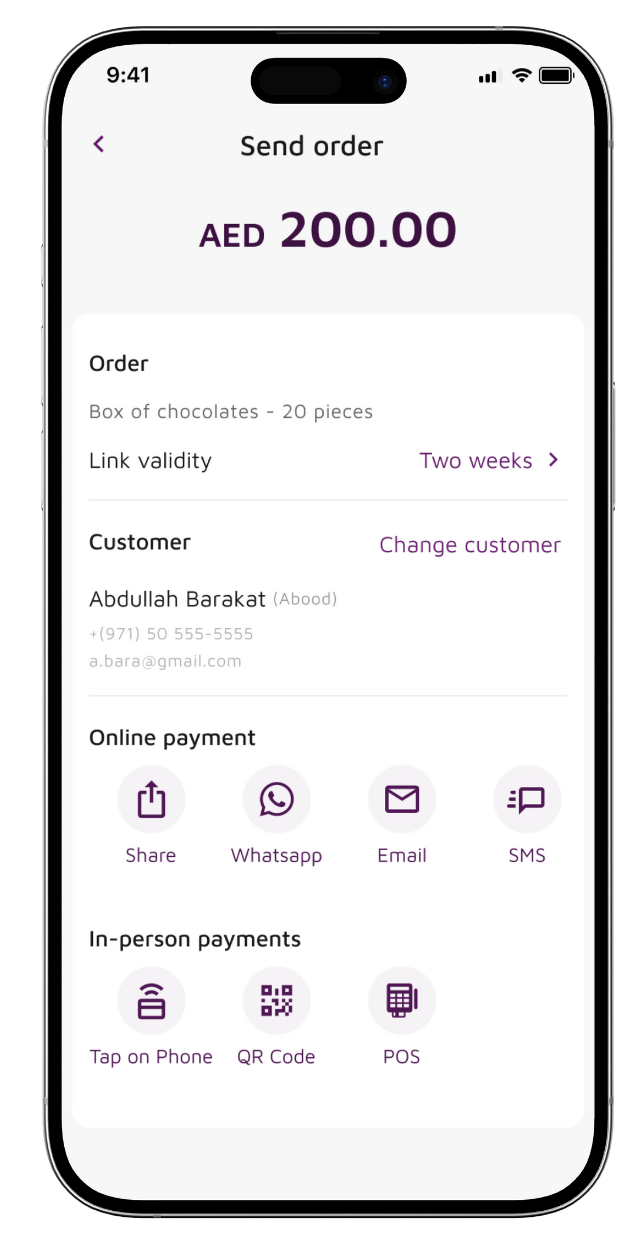

How to Create a Payment Link through the Paymennt App

Creating a payment link with Paymennt is a breeze:

- Open the app and click on the “+” icon.

- Enter the amount you wish to request from the customer.

- Click next, then add a description and ID reference for the transaction.

- Review your order to ensure everything is correct.

- Choose your preferred method to send the link (WhatsApp, email, SMS, or copy the link to share on social media).

How to Create Bulk Payment Links through the Paymennt App

The Paymennt app offers a bulk payment feature for businesses that need to sell multiple units of a product. Simply select the products you want to offer in bulk, generate a payment link, and share it with your customers via email, SMS, or social media. This feature is ideal for businesses that need to handle multiple transactions efficiently.

Payment Link Fee

Most platforms charge a small fee for creating and processing payments through a link. The fee varies depending on the service provider, transaction volume, and type of business. Payment fees are competitive and designed to offer merchants an affordable solution for seamless payments.

Payment links offer a fast, secure, and easy way for businesses to collect payments. Whether selling through social media, email, SMS, or in person, payment links can simplify checkout and improve sales. Paymennts platform takes it further by offering customizable features, bulk payment options, and added security, making it an ideal solution for businesses with a trade license.