The UAE is at the forefront of fintech innovation, with its payments industry expected to reach $27.3 billion by 2028. Through cutting-edge technology, regulatory advancements, and a push toward a cashless society, the country is rapidly transforming how businesses and consumers transact.

This article is based on a piece originally published on Finance Middle East and reflects the insights of Daumantas Grigaravicius, Head of the Middle East at Adyen, on the dominant payment trends shaping the UAE in 2025.

What’s Driving Fintech Growth in the UAE?

Several key factors are fueling the evolution of digital payments in the UAE:

Advanced Technologies – The adoption of AI, blockchain, and real-time payment systems is revolutionizing financial services. AI-driven personalization, blockchain-enabled loyalty programs, and faster payment processing are enhancing the user experience.

Progressive Regulatory Frameworks – The Central Bank of the UAE is leading initiatives such as the Open Finance framework, which encourages innovation by enabling seamless financial data sharing and personalized services.

Cross-Sector Collaboration – Fintech companies, banks, and regulators are working together to implement secure, scalable, and innovative payment solutions, ensuring financial services are both accessible and future-proof.

With these developments in mind, let’s explore the key payment trends dominating the UAE in 2025.

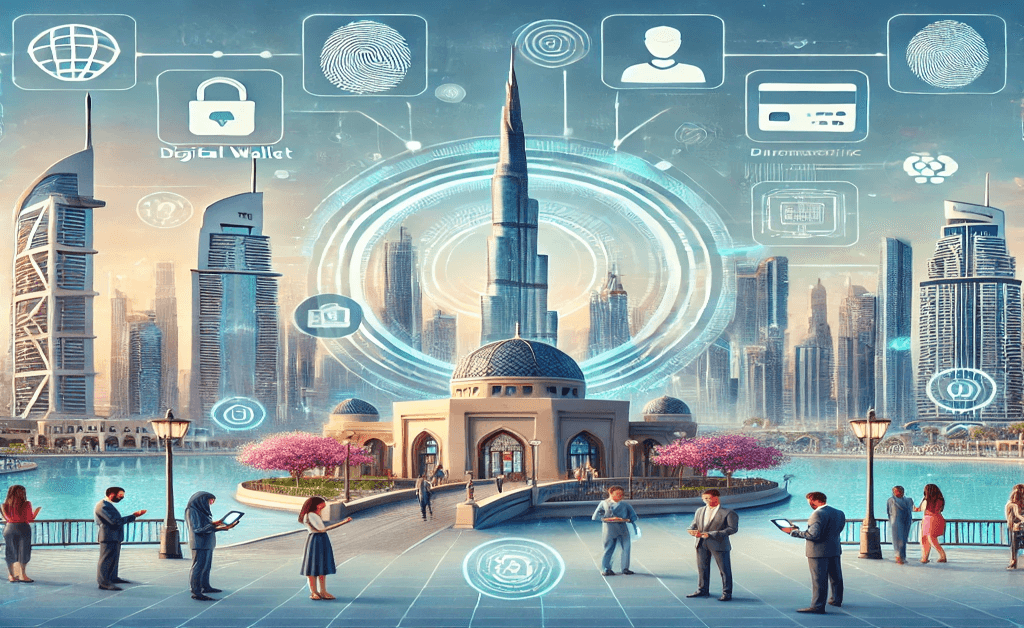

1. Digital Wallets Are Becoming the Norm

Digital wallets are cementing their place in the UAE’s payments ecosystem. Currently, 46% of the UAE population relies on e-wallets, and this market is projected to reach $7.18 billion by 2028.

- The UAE aims to go fully cashless by 2030, accelerating the adoption of digital wallets such as Careem Pay, Google Pay, and Samsung Pay.

- The shift is particularly crucial for expats, as digital wallets offer lower remittance costs, real-time exchange rates, and automated money transfers.

2. AI-Powered Payment Security

With the UAE’s commitment to AI innovation through its National Strategy for Artificial Intelligence 2031, AI is becoming a game-changer in payment security:

- AI-driven fraud detection can identify suspicious transactions in real time, reducing fraud risks.

- AI adapts dynamically to new threats, making security more proactive rather than reactive.

- Businesses can leverage AI for seamless authentication and risk analysis, ensuring smoother transactions.

3. Biometric Authentication Is on the Rise

Passwords and OTPs (one-time passwords) are slowly making way for biometric authentication, such as:

- Face recognition, fingerprint scans, and passkeys for frictionless access.

- More security and convenience – a Mastercard study revealed 90% of users trust biometrics over traditional passwords.

4. Contactless Payments Lead the Way

Contactless payments have dominated the UAE market, driven by both consumer demand and merchant adoption:

- 78% of UAE residents regularly use contactless payments.

- 49% of UAE SMEs have integrated contactless payment methods into their businesses.

- The launch of Tap to Pay on iPhone in 2024 allows businesses to accept payments directly through their devices.

Read Our Comprehensive Guide to Online Payments for Businesses

5. The Surge of Real-Time Payments

Real-time payment adoption is rapidly growing in the UAE, thanks to systems like Instant Payment Instruction (IPI):

- The total number of real-time payment transactions surged 27x from 2019 to 2023.

- Despite this growth, real-time payments currently represent only 1.5% of all UAE transactions – but this is expected to more than double to 3.6% by 2028.

Final Thoughts

The UAE’s payments landscape is evolving at an unprecedented pace, shaped by fintech advancements, regulatory support, and changing consumer behaviors. From AI-powered security to biometric authentication, real-time payments, and the rise of digital wallets, the country will become a fully cashless economy by 2030.

For businesses and consumers, staying ahead of these trends is crucial to leveraging the benefits of an efficient, secure, fast-evolving payments ecosystem.

This article is based on insights from Daumantas Grigaravicius, Head of the Middle East at Adyen, as published on Finance Middle East.