Apple Pay, a revolutionary mobile payment and digital wallet service developed by Apple Inc., has transformed the way we pay. This comprehensive guide delves into everything you need to know about Apple Pay, from its functionalities and security features to its benefits for both businesses and users.

Let’s dive into Apple Pay: A Comprehensive Guide for Businesses and Users

What is Apple Pay and How Does It Work?

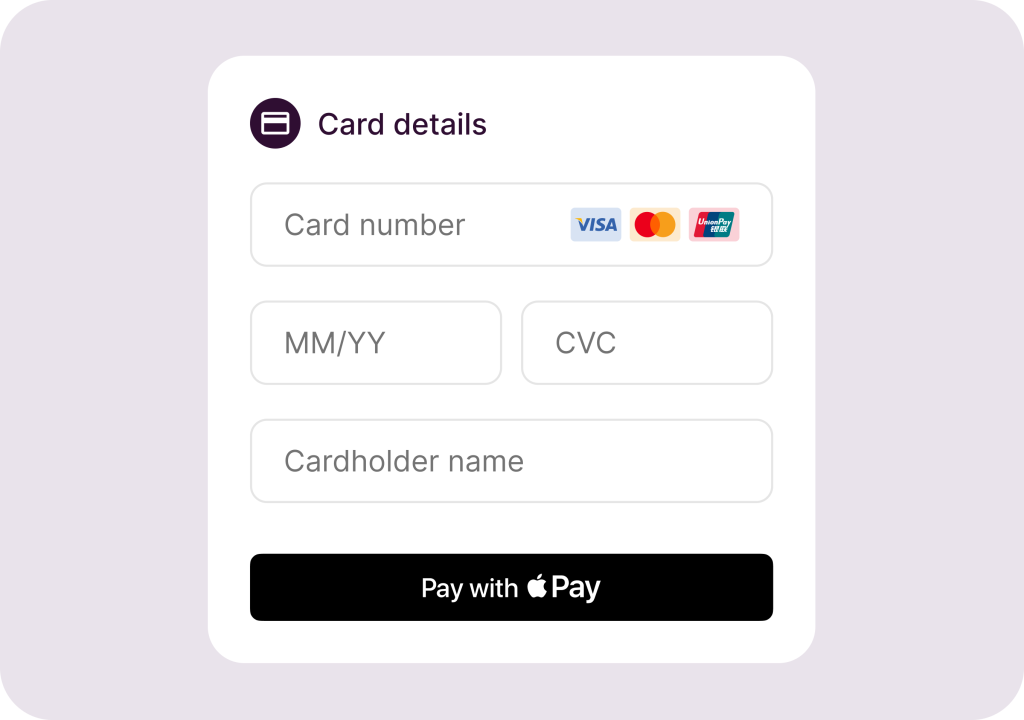

For users, Apple Pay offers a secure and convenient way to make payments in various scenarios:

- In-Person Transactions: Forget fumbling for cash or cards! Simply hold your iPhone, iPad, Apple Watch, or Mac near a contactless payment terminal displaying the Apple Pay symbol. Authentication through Touch ID, Face ID, or your device passcode completes the transaction securely.

- In-App Purchases: Gone are the days of entering lengthy credit card details within apps. With Apple Pay, a seamless click on the “Apple Pay” option and a quick fingerprint or facial scan finalize your in-app purchases.

- Web Payments: Participating online stores allow you to select Apple Pay as your payment method at checkout, streamlining the online shopping experience.

The Technology Behind Apple Pay: Secure and Contactless

Apple Pay utilizes Near Field Communication (NFC) technology to facilitate contactless payments. When your device nears a compatible payment terminal, the NFC chip within your device communicates securely, eliminating the need to swipe physical cards.

Unmatched Security: Protecting Your Information

Apple prioritizes user security. Apple Pay never transmits your actual credit or debit card number or personal information to merchants. Instead, a unique Device Account Number, encrypted and stored within your device’s Secure Element chip, is used for transactions. This ensures your sensitive data remains confidential.

Supported Cards and Availability:

Apple Pay integrates with most major credit and debit card providers, including Visa, Mastercard, American Express, and Apple Card (for US users). However, ensure your issuing bank supports Apple Pay for seamless functionality. The good news is that major banks in the UAE, like Emirates NBD, Abu Dhabi Commercial Bank, and many others, now offer Apple Pay compatibility.

Where Can You Use Apple Pay?

Look for the contactless payment symbol or the Apple Pay logo displayed at stores or online checkout pages. These indicate Apple Pay acceptance, allowing you to experience the convenience of contactless payments.

Beyond Physical Stores: A Multitude of Apps Embrace Apple Pay

A vast array of shopping apps, including Zara, Emirates Airlines, Starbucks, and countless others, have integrated Apple Pay as a payment option. Businesses with Paymennt.com accounts can also choose to accept Apple Pay under specific conditions.

Benefits of Apple Pay for Businesses:

- Enhanced Customer Experience: Offer your customers a faster, more secure, and convenient payment option, fostering customer satisfaction and loyalty.

- Reduced Transaction Times: Streamline checkout processes and minimize wait times, especially during peak hours.

- Improved Security: Apple Pay’s robust security features minimize the risk of fraud associated with traditional payment methods.

- Increased Sales Potential: By catering to the growing mobile payment trend, you can attract a wider customer base and potentially boost sales.

How to Enable Apple Pay Through Paymennt.com

For businesses with existing Paymennt.com accounts, enabling Apple Pay is a simple process:

- Open the Paymennt.com app and navigate to the Main Menu.

- Click on “Settings.”

- Select “Account.”

- Choose “Account Settings.”

- Locate and enable the “Apple Pay” option.

Don’t Have a Paymennt.com Account Yet?

Contact Paymennt today to open an account and unlock the potential of Apple Pay for your business!

In Conclusion:

Apple Pay has revolutionized mobile payments, offering a secure, convenient, and widely accepted payment solution for both businesses and users. By embracing Apple Pay, businesses can enhance customer experience, improve operational efficiency, and unlock new revenue opportunities. For users, Apple Pay simplifies transactions, eliminates the need to carry cash or cards, and prioritizes security. As mobile payment technology continues to evolve, Apple Pay remains a frontrunner, shaping the future of commerce.