The intricate world of chargebacks can be a daunting landscape for merchants. Facing disputes, financial losses, and tight deadlines can leave you feeling overwhelmed. But fear not! This comprehensive guide empowers you to navigate the chargeback process with confidence. We’ll delve into every step, highlight common merchant challenges, and equip you with effective strategies to minimize disputes and maximize success.

Understanding the Chargeback Process

What is a Chargeback?

A chargeback refers to the entire workflow encompassing a cardholder’s dispute, from the initial inquiry to its final resolution. This multi-party process involves:

- Cardholder: The individual who owns the disputed card.

- Merchant: The business that provided the contested goods or services.

- Issuer: The cardholder’s bank, is responsible for issuing the card.

- Acquirer: The merchant’s bank, responsible for receiving payments.

- Processor: The entity facilitating the flow of payment data.

- Card Network: Organizations like Visa or Mastercard that oversee the chargeback process.

Why are Chargebacks a Challenge for Merchants?

- Limited Warning: Merchants often receive no prior notification before a chargeback is filed, creating difficulties in preparing a defense.

- Financial Burden: Provisional refunds remove disputed funds from merchant accounts, impacting cash flow.

The cost of chargebacks is expected to reach more than $1 billion by 2023, up from $690 million in 2020, according to an Ethoca-commissioned Aite Group study.

- Strict Deadlines: Responding to chargebacks requires swift action to gather evidence and submit a rebuttal within a limited timeframe.

- Complexities in Representing: Compiling the necessary documentation and adhering to various requirements can be challenging.

- Second-Cycle Chargebacks: Even after a win, new information can lead to a second round of disputes, extending the process and incurring additional costs.

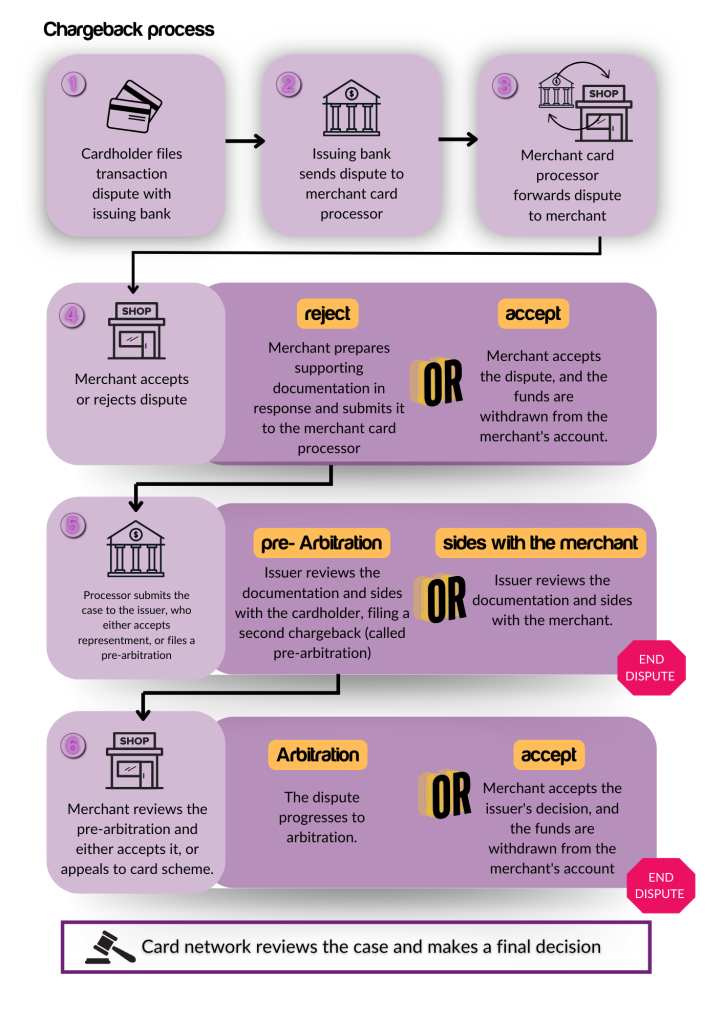

The Chargeback Process: A Step-by-Step Breakdown

Initial Customer Dispute

The cardholder initiates the process by contacting their issuing bank to dispute a transaction.

Merchant Challenge: Often, merchants are unaware of a dispute until it’s already underway.

Chargeback Process Tip: Pay close attention to reason codes for each dispute and seek clarification from the bank if inconsistencies arise. Tailor your response to address the specific claim presented.

The Provisional Refund

- Upon receiving a chargeback request, the cardholder receives a provisional refund.

- The disputed amount is transferred from your acquirer back to the issuer, and your merchant account is debited for the original transaction amount and any applicable fees.

Merchant Challenge: Merchants may be unaware of a chargeback until the funds have been withdrawn, creating cash flow issues.

Chargeback Process Tip: Stay vigilant and monitor communications from your bank or payment processor. Respond promptly to dispute notifications due to the limited window for response.

Reviewing the Reason Code

- The issuing bank assigns a numeric reason code to the chargeback, explaining the cardholder’s claim.

- This information is electronically sent to your acquirer, who forwards it to you for review.

Merchant Challenge: Reason codes, while indicative of the claim, may not always be accurate and can reflect the cardholder’s perspective

Chargeback Process Tip: While addressing the reason code is essential, focus on uncovering the true root cause of the dispute. Understanding the true trigger is crucial for developing effective prevention tactics.

The Option to Re-Present (Defend)

- You have the option to either accept the chargeback or dispute it if you believe the claim is invalid.

- Carefully examine the Chargeback Debit Advice Letter (if applicable) from your acquirer to determine if a dispute is worthwhile.

Merchant Challenge: To contest a chargeback, specific documentation adhering to representment requirements is necessary. This may include return policies, proof of delivery, signed receipts, or other relevant evidence. Strict deadlines exist for submitting this evidence.

Chargeback Process Tip: Act quickly! If you choose to fight the chargeback, ensure the evidence aligns with the reason code. Prepare a clear rebuttal letter, gather sufficient supporting documentation, and establish a well-defined strategy to submit everything within the required timeframe.

Compile Your Documents

- Time is of the Essence: Gather the necessary documentation promptly as deadlines for submitting a rebuttal are typically tight.

- Key Documents: Prepare a rebuttal letter, a reversal request, and any supporting evidence to bolster your case. The specific documents required may vary depending on the card network, issuer, or reason code involved.

Merchant Challenge: Collecting the necessary evidence within a short timeframe can be challenging. Many merchants struggle to compile a strong rebuttal due to time constraints.

Chargeback Process Tip: Stay organized and prepared. Maintain detailed transaction records, customer information, and other relevant data to facilitate a swift response and increase your chances of a successful dispute

Submit the Representment Package

- After compiling your rebuttal package, including all supporting evidence, you’ll need to submit it to your acquiring bank.

- The acquirer will review the submission for completeness before forwarding it to the issuing bank.

Merchant Challenge: Along with the tight turnaround time, each card network has its own set of rules for submitting a representment package. Different banks also have varying document submission requirements, making the process more complex.

Chargeback Process Tip: Familiarize yourself with each card network’s specific requirements. Knowing the documentation standards and timelines will help you stay ahead. Using chargeback response templates can also streamline the process when applicable

Bank Review and Decision

Once the issuing bank receives your represented package, they will review the evidence and make one of three decisions:

- Issuer rules in your favor: The chargeback is reversed, and the funds are returned to your account.

- Issuer rules in favor of the cardholder: The chargeback remains in place.

- You win, but a second chargeback is filed: New information or a change in the reason code can lead to a second-cycle chargeback.

Merchant Challenge: Second-cycle chargebacks can be frustrating and costly.

Chargeback Process Tip: Maintain open communication with the bank and try to resolve the issue directly with the cardholder if possible. Arbitration should be considered as a last resort due to its complexity and cost.

Arbitration

If a dispute reaches this stage, you appeal to the card network for an unbiased decision.

Merchant Challenge: Arbitration can be costly and time-consuming, with no guarantee of a favorable outcome

Chargeback Process Tip: Consider arbitration only if the disputed amount justifies the risks. Consult with your acquirer before proceeding.

What Happens After a Chargeback?

While card networks typically do not permit appeals after an arbitration loss, you may have legal recourse.

Merchant Challenge: Pursuing legal action can be costly and time-consuming.

Chargeback Process Tip: Consider sending a demand letter to the cardholder before initiating legal action. If the cardholder refuses to comply, small claims court may be an option

Tips to Avoid Chargebacks

- Enhance Customer Service: Provide excellent customer service to address issues before they escalate to chargebacks.

- Clarify Billing Descriptors: Ensure your business name and contact details are clearly displayed on customer statements.

- Set Up Alerts: Implement chargeback alerts to promptly address disputes.

- Utilize Visa & Mastercard Tools: Take advantage of data-driven tools to resolve disputes at the inquiry stage.

- Offer Hassle-Free Refunds: Encourage customers to opt for refunds instead of chargebacks.

- Deploy Fraud Detection Tools: Implement measures like requiring CVV, using AVS, and adopting 3-D Secure to validate buyers and reduce fraudulent chargebacks.

By understanding the chargeback process and implementing these strategies, merchants can significantly reduce their financial losses and protect their business reputation.