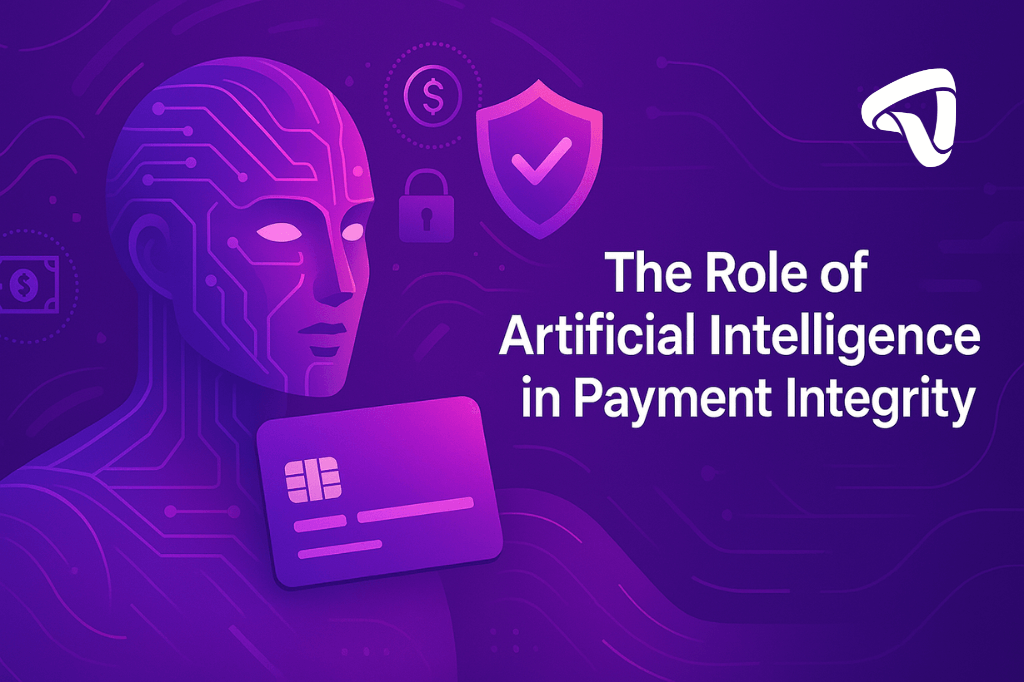

Artificial intelligence (AI) is transforming the payment industry, streamlining processes, enhancing security, and improving overall efficiency. Traditionally, payment integrity has been hindered by manual workflows, outdated systems, and compliance challenges, leading to increased operational costs and a higher risk of errors. AI offers a proactive solution, automating complex tasks, detecting anomalies, and optimizing decision-making to create a more accurate and efficient payment ecosystem.

How AI is Revolutionizing Payment Integrity

AI and machine learning are playing a crucial role in refining both pre-payment and post-payment processes:

- Pre-payment analysis – AI can analyze transactions in real-time, identifying potential errors, fraud, or inconsistencies before a payment is processed, reducing the need for costly post-payment corrections.

- Post-payment accuracy – AI-driven systems can efficiently review large volumes of payment data, flagging anomalies and prioritizing cases that require human intervention.

Read about the Concept of Artificial Integrity: The Path for the Future of AI

Key Areas Where AI is Making an Impact

- Automated Transaction Processing – AI reduces reliance on manual reviews, expediting payment approvals while minimizing processing delays.

- Fraud Detection & Prevention – Machine learning algorithms can identify suspicious patterns, helping to prevent fraudulent activities and unauthorized transactions before they occur.

- Predictive Analytics for Risk Management – AI enables payment providers to anticipate potential risks, helping businesses and financial institutions proactively address security threats and inefficiencies.

- Enhanced Compliance & Regulatory Adherence – AI ensures that payment systems comply with industry regulations by automating checks and flagging potential compliance violations.

- Improved Customer Experience – AI-powered chatbots and virtual assistants enhance customer service by providing instant transaction support and dispute resolution.

The Future of AI in Payment Integrity

As AI continues to advance, its role in payment integrity will evolve with new innovations:

- Real-Time Payment Validation – AI will enable instant validation of transactions, reducing wait times and increasing transparency.

- Adaptive Fraud Prevention – With continuous learning, AI can stay ahead of evolving fraud tactics by dynamically updating its fraud detection models.

- Personalized Payment Solutions – AI will facilitate customized pricing models and payment plans based on user behavior and financial patterns.

- Blockchain Integration – Combining AI with blockchain technology could enhance security and transparency, ensuring tamper-proof transaction records.

Read about The Future of Payments in the UAE: Key Trends to Watch in 2025

Challenges & Considerations

Despite its advantages, AI implementation in payment integrity comes with certain challenges:

- Data Standardization & Quality – AI relies on clean, structured data. To maximize its potential, the industry must focus on improving data interoperability.

- Privacy & Security Concerns – AI-driven payment systems must maintain strict security measures to protect sensitive financial data.

- Transparency & Explainability – AI decisions should be clear and understandable, ensuring compliance with regulations and building trust among stakeholders.

- Human Oversight – While AI enhances efficiency, human intervention remains essential for managing complex cases and ensuring ethical decision-making.

Conclusion

AI is reshaping integrity across the financial ecosystem, empowering institutions, businesses, and providers to detect fraud, minimize errors, and strengthen compliance. As AI-driven solutions evolve, embracing these innovations is essential to stay ahead in today’s fast-moving digital landscape. With the right balance of automation and human oversight, the industry can achieve greater security, efficiency, and accuracy. AI in payment is no longer optional—it’s the future.