What is Representment?

Chargeback representment is a critical process that allows merchants to dispute invalid payment card chargebacks. By providing compelling evidence to the bank, you can challenge the dispute and potentially overturn the chargeback, recovering lost revenue.

When to Represent

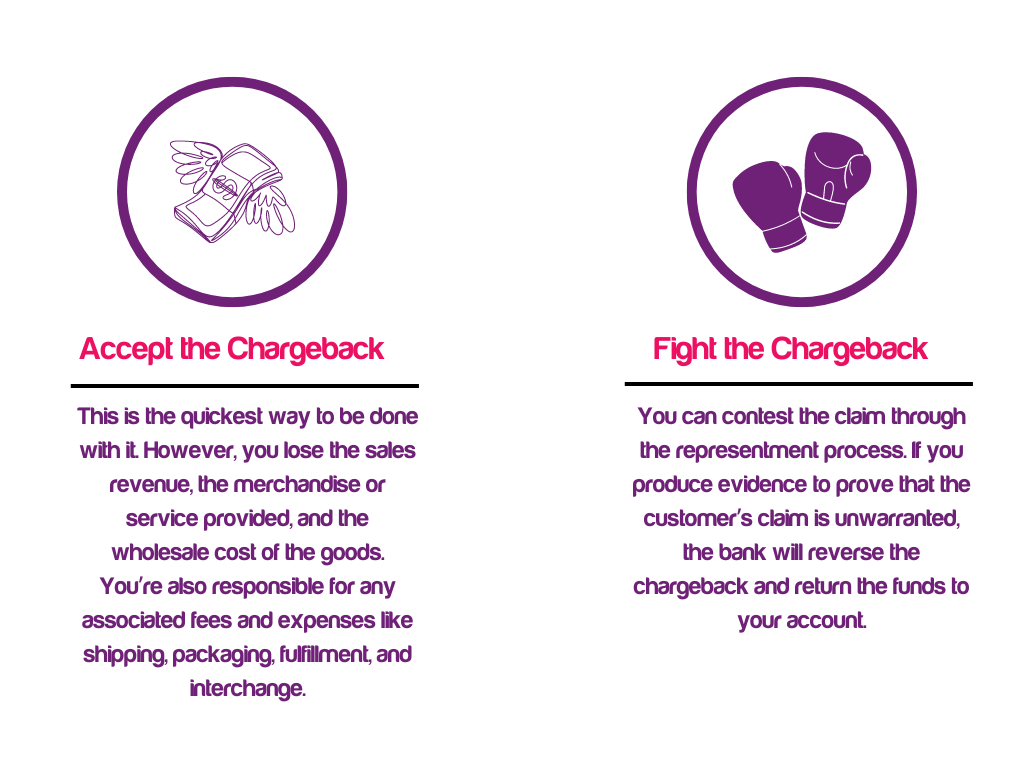

When faced with a chargeback, you have two options:

- Accept the Chargeback: This is the quickest option but comes at a cost, including lost revenue, merchandise, and associated fees.

- Represent the Chargeback: By providing evidence to disprove the customer’s claim, you can potentially overturn the chargeback and recover the funds.

The Benefits of Representment

- Recover Lost Revenue: Successfully representing a chargeback can help you recover lost revenue.

- Protect Your Reputation: Avoiding excessive chargebacks is essential for maintaining a positive reputation with payment processors.

- Minimize Financial Impact: Chargebacks can lead to increased fees and penalties. Successful representment can help mitigate these costs.

Key Considerations for Successful Representment:

Timeliness: Respond to chargebacks promptly to avoid missing deadlines.

Clear Communication: Clearly articulate your position and provide a concise rebuttal letter.

Evidence Quality: Gather strong, relevant evidence to support your case.

Understanding Reason Codes: Familiarize yourself with common reason codes to tailor your response effectively.

By understanding the importance of chargeback representment and following these key considerations, you can increase your chances of successfully disputing invalid chargebacks and protecting your business’s financial health

Why Representment Matters

Reclaim Lost Revenue

Chargebacks can significantly impact your bottom line. By representing invalid chargebacks, you can reclaim lost funds and protect your business’s financial health.

Protect Your Reputation

Failure to represent chargebacks can negatively impact your reputation with banks and payment processors. Consistent representment demonstrates your commitment to addressing disputes and can help you maintain a positive standing.

Combat Fraud and Abuse

Representment is a crucial tool for combating fraudulent or abusive chargeback practices. By challenging invalid claims, you contribute to the overall integrity of the payment ecosystem.

Long-Term Benefits

Consistently contesting invalid chargebacks can have long-term benefits:

- Reduced chargeback rates can positively impact your profitability.

- Enhanced Reputation: A positive reputation with banks and consumers can lead to better terms and fewer challenges in securing processing services.

- Reduced Future Chargebacks: Addressing chargebacks proactively can help prevent future disputes.

By understanding the importance of representment and taking a proactive approach, you can protect your business’s financial health and maintain a positive reputation in the payments industry

Understanding the Pre-Representment Process

Identifying the Chargeback Origin

Before initiating representment, it’s crucial to determine the root cause of the chargeback. This can be challenging as the dispute process may begin due to a cardholder complaint or be initiated by the issuer.

Understand Chargeback Risk with Paymennt’s Comprehensive Guide

Receiving the Chargeback

Once the issuer files a claim, it is sent to the acquirer, who then forwards it to you. The first step is to identify the chargeback reason code, a shorthand explanation of the dispute. While the reason code may not always accurately reflect the true cause, you must respond based on the information provided.

Key Considerations:

- Investigate the Dispute: Gather information about the transaction and the cardholder’s claim to fully understand the situation.

- Review Reason Codes: Familiarize yourself with common reason codes to effectively respond to disputes.

- Prepare for Representment: Once you’ve identified the reason code and gathered evidence, you can proceed with the representment process

Building & Submitting a Representment Case in 4 Steps

Step 1: Note the Response Time Limit

– Adhering to the strict deadlines for responding to chargebacks is crucial.

– The exact timeframe varies based on the card scheme and reason code.

– Review the Chargeback Debit Advice Letter for specific guidelines.

Step 2: Assemble Compelling Evidence

- Gather essential evidence to support your case, such as:

– Copies of sales receipts, order forms, tracking numbers, and proof of delivery

– Return policy, product descriptions, and communication records

- Ensure evidence directly addresses the specified reason code, even if you believe it’s inaccurate.

Step 3: Draft a Rebuttal Letter

- Gather essential evidence to support your case, such as:

– Copies of sales receipts, order forms, tracking numbers, and proof of delivery

– Return policy, product descriptions, and communication records

- Ensure evidence directly addresses the specified reason code, even if you believe it’s inaccurate.

Step 4: Compile Forms & Submit Your Representment

- Submit your rebuttal letter and supporting evidence to your acquiring bank.

- The acquirer will forward your submission to the issuing bank for review.

- Ensure you meet all deadlines and follow the bank’s specific requirements.

- Additional supporting documents like a Chargeback Adjustment Reversal Request and Chargeback Debit Advice Letter may be necessary.

By following these steps and paying close attention to deadlines, you can increase your chances of a successful chargeback representment

Chargeback Win Rate: Evaluating Representment Success

Understanding Chargeback Win Rate

Your chargeback win rate is the percentage of chargebacks you successfully dispute and win. It reflects the effectiveness of your representment efforts and your ability to recover lost funds.

The Importance of a High Win Rate

- Financial Impact: A high win rate directly impacts your bottom line by reducing financial losses from chargebacks.

- Reputation: Consistent success in representing chargebacks demonstrates your commitment to addressing disputes and can improve your reputation with banks and consumers.

Tracking and Analyzing Win Rates

- Monitor Win Rate: Regularly track your chargeback win rate to assess the performance of your representment process.

- Identify Patterns: Analyze your win rate over time to identify trends or areas for improvement.

- Take Action: If you notice a decline in your win rate, investigate the underlying causes and implement necessary changes.

By consistently monitoring and analyzing your chargeback win rate, you can identify opportunities to improve your representment strategies and protect your business’s financial health

Enhance Your Chances of Winning

Key Strategies for Successful Chargeback Representment:

- Understand the Regulations: Stay informed about the latest chargeback representment regulations to ensure compliance.

- Establish a Filing System: Organize your documents for easy access and timely submission.

- Act Quickly: Respond to chargebacks promptly to meet tight deadlines and avoid penalties.

- Stay Updated on Reason Codes: Familiarize yourself with the specific reason codes for each card network to provide tailored responses.

- Effective Communication: Craft a clear, concise, and professional rebuttal letter to present your case effectively.

- Avoid Overreliance on Automation: While automation can be helpful, manual review and customization are essential for optimal results.

- Build Relationships with Banks: Consult with multiple issuing banks to understand their specific requirements and tailor your approach accordingly.

- Address Every Dispute: Consistently representing chargebacks demonstrates your commitment to protecting your revenue and maintaining a positive reputation.

By implementing these strategies, you can significantly increase your chances of successfully representing chargebacks and protecting your business’s financial health.

What Happens After Representment?

Issuer Decision

Once you submit your representment, the issuer will review the evidence and make one of the following decisions:

- Rule in Your Favor: The chargeback is reversed, and the funds are returned to your account.

- Rule in Favor of the Cardholder: The issuer rejects your claim based on the initial evidence.

- Rule in Favor of the Cardholder with New Evidence: The issuer rejects your claim due to additional evidence supporting the cardholder’s position.

Average Win Rates

The average representment win rate is around 32%, indicating that a significant number of chargebacks are not overturned. This can lead to a subsequent chargeback, often referred to as a “pre-arbitration” or “pre-arb” chargeback.

Key Takeaways:

- Understand Issuer Decisions: Be aware of the possible outcomes of the representment process.

- Prepare for Potential Rejections: A significant portion of chargebacks are not overturned.

- Consider Further Action: If a chargeback is rejected, you may have the option to escalate the dispute to arbitration.

By understanding the potential outcomes of representment and preparing for potential rejections, you can make informed decisions about your next steps

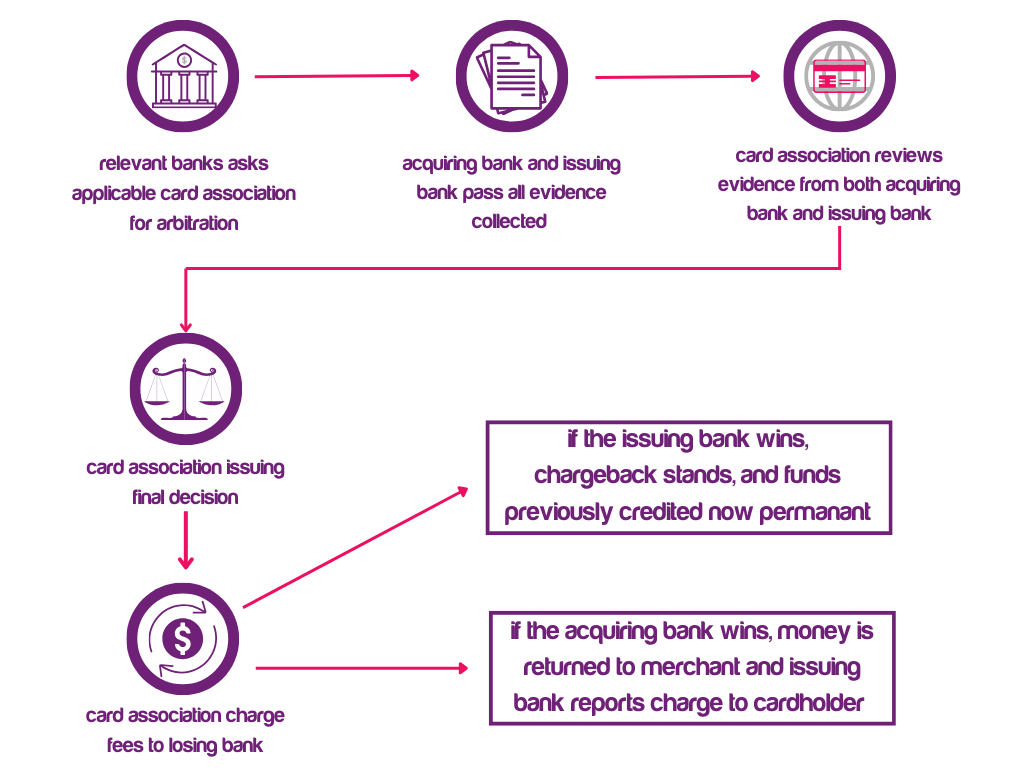

Second Chargebacks & Pre-Arbitration

Understanding the Process

Mastercard Arbitration and Visa Pre-Arbitration are the final stages for resolving disputes that persist beyond the initial chargeback phase. These processes involve a neutral evaluation of the evidence by the payment card network.

Key Similarities:

- Purpose: Both processes aim to provide a fair and final resolution for disputes.

- Evidence Submission: Merchants have the opportunity to present evidence supporting their case.

- Neutral Arbitration: The payment card network acts as a neutral arbiter, making a binding decision.

- Finality: The decisions made through Arbitration or Pre-Arbitration are conclusive and cannot be further appealed.

Key Differences:

While the core purpose and structure of both processes are similar, there are minor differences:

- Terminology: Mastercard uses the term “Arbitration,” while Visa refers to the process as “Pre-Arbitration.”

- Specific Procedures: The exact steps and requirements may vary slightly between the two networks.

Navigating Second Chargebacks

- Understand the Process: Familiarize yourself with the specific procedures and requirements for Mastercard Arbitration or Visa Pre-Arbitration.

- Prepare Thoroughly: Gather strong evidence to support your case and present it effectively.

- Seek Expert Help: Consider consulting with a chargeback expert for guidance and support.

By understanding the second chargeback process and preparing thoroughly, you can increase your chances of a favorable outcome. Remember, these processes are your last opportunity to dispute the chargeback, so it’s essential to approach them with a strategic mindset

Next Steps: Pursuing Further Action

If arbitration doesn’t go in your favor, you may still have options to pursue.

1. Debt Collection

- Consider Legal Action: If the value of the goods or services warrants it, you may explore debt collection as a last resort.

- Evaluate Costs and Benefits: Carefully assess the potential costs and benefits of pursuing debt collection before proceeding.

2. Small Claims Court

- Consider Your Options: Small claims court can be an avenue for resolving disputes involving smaller amounts of money.

- Understand Local Procedures: Familiarize yourself with the specific rules and procedures for small claims court in your jurisdiction.

Key Considerations:

- Assess the Merits of Your Case: Carefully evaluate whether the potential benefits justify the costs and complexities of further legal action.

- Consider Alternatives: Explore other options, such as mediation or negotiation, before pursuing legal action.

- Seek Legal Advice: Consult with an attorney to understand your options and the potential risks and rewards involved.

Remember: Legal action should be considered a last resort and pursued only when the value of the goods or services justifies the effort and expense.

The Challenges of Representment

Successfully representing chargebacks can be challenging due to:

- Complex Regulations: Understanding the constantly evolving regulations and terms can be difficult.

- Emerging Fraud Tactics: Staying ahead of new fraud strategies is essential for effective representment.

- Balancing Aggressiveness: An overly aggressive approach can negatively impact your relationship with banks and payment processors.

- Limited Insights: Lack of access to industry intelligence and data can hinder your decision-making.

- Misallocated Resources: Focusing on representment can divert resources from other critical areas of your business.

The Importance of Professional Assistance

To overcome these challenges and improve your chances of successful representment, consider seeking professional assistance. A chargeback management expert can provide valuable guidance, support, and expertise in navigating the complex world of chargebacks.

Benefits of Professional Assistance:

- Deep Understanding: Experts possess in-depth knowledge of chargeback regulations and trends.

- Strategic Guidance: They can help you develop effective representment strategies.

- Time and Resource Savings: Outsourcing chargeback management can free up your team to focus on other critical areas.

- Improved Win Rates: Professional assistance can significantly increase your chances of successfully overturning chargebacks.

By partnering with a reputable chargeback management firm, you can enhance your representment efforts and protect your business’s financial health

Conclusion: Empower Your Business with Effective Chargeback Management

The Importance of Proactive Action

Chargebacks can significantly impact your business’s financial health and reputation. By understanding the various risk factors and implementing effective prevention and mitigation strategies, you can significantly reduce the likelihood of disputes and protect your revenue.

Key Takeaways:

- Stay Informed: Stay updated on industry trends, regulations, and emerging fraud tactics.

- Identify and Address Risks: Proactively identify potential chargeback triggers and implement targeted solutions.

- Utilize Expert Guidance: Consider partnering with a chargeback management firm for professional support and expertise.

- Prioritize Prevention: Focus on preventing chargebacks through robust fraud prevention measures and excellent customer service.

- Effective Representment: When disputes arise, be prepared to represent chargebacks effectively and increase your chances of a favorable outcome.

Empower Your Business

By taking a proactive approach to chargeback management, you can safeguard your business’s financial health, protect your reputation, and ensure long-term success. Don’t let chargebacks hinder your growth. Take control and implement the strategies outlined in this guide to empower your business and thrive in the competitive marketplace.