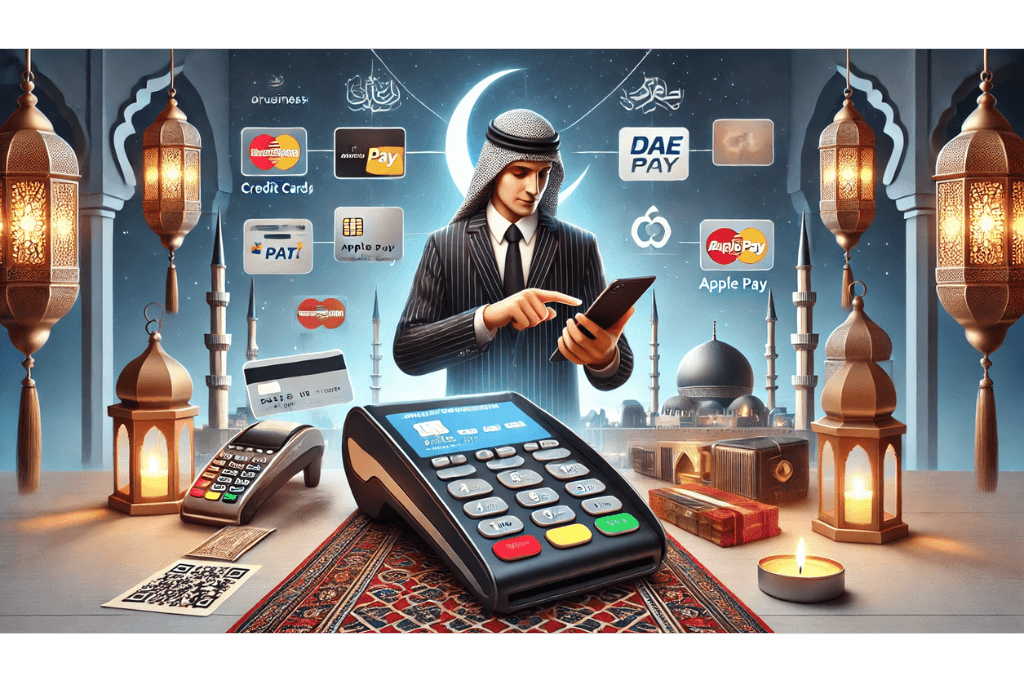

Several factors to consider when choosing payment methods for your small business include average transaction time and the cost of cash versus digital payments or cashless alternatives. According to the global research and consulting firm IHL Group, the average cost of accepting cash payments ranges from 4% to 15% of the total transactions.

During the COVID pandemic and the quarantine restrictions, the local and global markets observed that 95% of customers preferred to pay by credit/debit card over cash. According to Zawya, digital payment in Saudi Arabia currently represents 36% of the majority (30%) through credit cards.

The global and local markets also witnessed clear growth in terms of digital payment. According to an Ernst & Young report, 69% of financial leaders in the Middle East plan to automate or are automating multiple finance processes

The Main Thing Retailers Should Understand Before Avoiding Digital Payments

Despite the initial perception of higher costs, cash transactions often involve hidden expenses that can outweigh the direct fees associated with digital payments. Merchants may overlook the costs of cash handling, security measures, delivery, order cancellations, and manual processes like daily deposits and audits. These hidden costs can significantly impact profitability.

By understanding these factors, retailers can make informed decisions about their payment methods and avoid the pitfalls of relying solely on cash.

In addition, to the extensive costs of cash transactions, the pandemic has made customers and business owners prefer precautionary measures to reduce the risks of infection associated with cash and credit transactions, making it harder to ignore the rapid growth of cashless payments.

The average cost per transaction is 9.1% of the total cash received, 2.95% per transaction, or 1 AED per transaction.

Learn more about the Fees for Card-Present vs. Digital Payments

Transaction time: Cash Vs. Credit Card transactions

On average, it takes about two seconds to process a credit card transaction, which speeds up the process for the customer and the retailer. In addition, the fact that customers can pay remotely on e-payment gateways makes receiving payments from regional or international customers easier and faster, hence providing a wider customer base for the reseller.

During the coronavirus pandemic, Paymennt developed a solution that allows companies to receive payments from customers via the internet without the high cost of POS devices with the launch of The Paymennt app. This mobile application enables merchants to manage e-payments by sending payment links and accepting online payments. For example, a person in Abu Dhabi can pay for a product in Dubai and have it delivered as a gift without the hassle of cash on delivery or relying on other ways to transfer the amount to the reseller. Resellers can also receive money from their customers without creating a website that supports online payments or waiting for bank transfers.